DeFi Opportunities with Stader

Liquid staking makes staking more fun. Now for the same amount of capital you have double the liquidity than before.

Liquid staking makes staking more fun. Now for the same amount of capital you have double the liquidity than before.

That means you continue to get rewards for staking while using the same liquidity in DeFi strategies generating yield at the same time. How?

To answer that you need to understand how liquid staking works. So here is a brief idea on the topic.

When you stake your assets in a liquid staking protocol, the protocol mints a liquid token acknowledging the staked assets.

You can move that liquid token anywhere you want including lending protocols or other yield farming DeFi strategies.

When users stake BNB, they mint BNBx. Stader then takes the BNB deposited by users and stakes them optimally across various validators on the network. As these validators process transactions, they generate rewards which are funneled back into the staking pool increases the value of the BNBx in circulation.

Thus, BNBx is a reward-bearing liquid token i.e. the value of 1 BNBx token vs. BNB increases over time as staking rewards accumulate.

So how do you use $BNBx in yield farming?

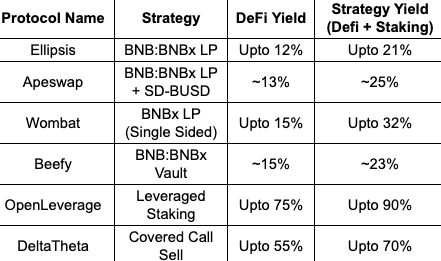

We have 6 options for you that we’ll discuss in this blog post.

Wombat Exchange — Single-Sided BNBx LP

Step 1 is to stake your $BNB in Stader to mint the $BNBx in order for you to follow the later steps.

After that go to Wombat and scroll down to the BNB Pool. Go to the BNBx section to deposit and stake your $BNBx.

The Wombat BNBx LP will get you up to 15% in pure yield and a total of up to 32% in staking rewards and yields.

All you need to do now is periodically collect your rewards from Wombat. And if you want to boost your yields even higher, you can lock up $WOM tokens.

Find out a step-by-step guide here

Ellipsis — BNBx:BNB LP

Ellipsis is another of Stader’s partner ecosystems where you can use $BNBx to generate rewards.

This is a bit different from the last process, here you stake only half of your total intended capital in Stader. Stake that half and collect the $BNBx and then go to Ellipsis and find the BNBx:BNB farm.

Now take your BNBx and half of your BNB and stake it on the farm to earn $EPX tokens. The yield on Ellipsis can go up to 12% and when you add staking rewards it can go as high as 21%.

Find out a step-by-step guide here

ApeSwap — BNBx:BNB LP

The process of ApeSwap is very similar to Ellipsis where you only stake half your BNB to get BNBx and stake them together in the BNBx:BNB farm to earn $SD tokens.

You can also earn even more yields by farming SD:BUSD farm to earn BANANA tokens.

With ApeSwap you stand a chance to get a total yield of 13% when you add staking rewards it can go as high as 25%.

Find out a step-by-step guide here

Beefy — BNBx:BNB LP Vault

Beefy also follows a similar process to ApeSwap and Ellipsis.

You stake half the BNB to get BNBx and stake the combined asset to a BNBx:BNB pool on Ellipsis and get the BNBx:BNB LP tokens.

Then head over to the Beefy Ellipsis vault and deposit the LP tokens.

Once you have done that, you’re eligible for up to 15% in pure yield and a total of up to 23% in staking rewards and yields.

OpenLeverage — Leveraged Staking

OpenLevarage is a little different than the others. You leverage your capital and take a 5.9x-long position on BNB.

To understand more about that, check out this article.

Once you have opened your long position, now wait for 48 hours or more to be eligible for SD rewards. With 5.9x leverage, the total yields can go up to 90% with staking rewards included

DeltaTheta — Covered Call Sell

In DeltaTheta, you do options trading to make a profit out of it.

Here is a short guide for you to make 55% in pure yield just selling options.

Open Delta.Theta and create a limit order to sell a call on BNBx.

Choose your desired date of expiry, put in collateral or a premium in USD, and then earn BUSD as per your option contract.

We have written a whole article explaining how it works.