Diving Deeper into SD Tokenomics

The evolution of SD tokenomics highlights the power of a thoughtful, community-driven approach to building in DeFi. At the heart of Stader Labs lies the SD token — a multifaceted utility and governance asset driving innovation and community engagement across the platform.

In the ever-evolving world of DeFi, the success of any ecosystem hinges on its ability to align user incentives, create sustainable growth, and build a foundation for long-term value. At the heart of Stader Labs lies the SD token — a multifaceted utility and governance asset driving innovation and community engagement across the platform. Let’s explore the intricacies of SD tokenomics and how the SD Tokenomics Reboot represents a bold leap toward scalability and resilience.

The narrative behind SD Tokenomics

Since its inception, the SD token has been designed to go beyond just being a governance token. It serves as a critical pillar for:

- Incentivizing participation: SD rewards liquidity providers, ETHx node operators, and community contributors, ensuring active engagement across the ecosystem.

- Empowering governance: Through the StaderDAO, SD holders help shape the future of the protocol by voting on key proposals & initiatives.

- Fueling decentralization: With SD, ETHx node operators can bond just 0.4 ETH worth of SD to run validators and secure the Ethereum network. Further, SD holders can delegate SD to the SD Utility Pool and get rewarded for banking node-operators run validators with ETH-only exposure

These features have positioned SD as a cornerstone of the Stader Labs ecosystem, but the dynamic nature of the blockchain industry demands adaptability. Recognizing this, Stader Labs launched the SD Tokenomics Reboot to ensure the token’s utility and sustainability evolve alongside the broader DeFi landscape.

SD Tokenomics Reboot: Why was it Necessary

In June 2024, Stader Labs executed a comprehensive overhaul of SD tokenomics to align with the protocol’s growth trajectory and the needs of its community. Here’s why the reboot was pivotal:

- Aligning supply with ecosystem growth: A strategic 30M SD Mega Burn reduced the total supply to 120M tokens, optimizing the supply and enhancing tokenomics.

- Creating a sustainable sink: The introduction of Quarterly Buybacks, allocating 20% of Stader’s annual revenue for buybacks, creates a consistent sink for the token, benefiting holders by reducing circulating supply and creating a deflationary effect on the token supply. Various utilities like SD Utility Pool and the use of SD as slashing insurance for ETHx node operators lock up SD optimizing the circulating supply even further.

- Enhancing utility: The integration of the SD Utility Pool empowers ETHx node operators to run validators with ETH-only exposure, driving wider adoption by Ethereum node operators while bolstering Ethereum decentralization. ETHx Permissioned node operators also delegate a part of their rewards to the SD Utility Pool to get the benefits of insurance against slashing risks.

- Expanding Beyond Staking: The Tokenomics Reboot positions SD to support future innovations, including new product initiatives like Cabbage that extend Stader’s influence into new areas of the web3 ecosystem.

SD token supply and unlock schedule

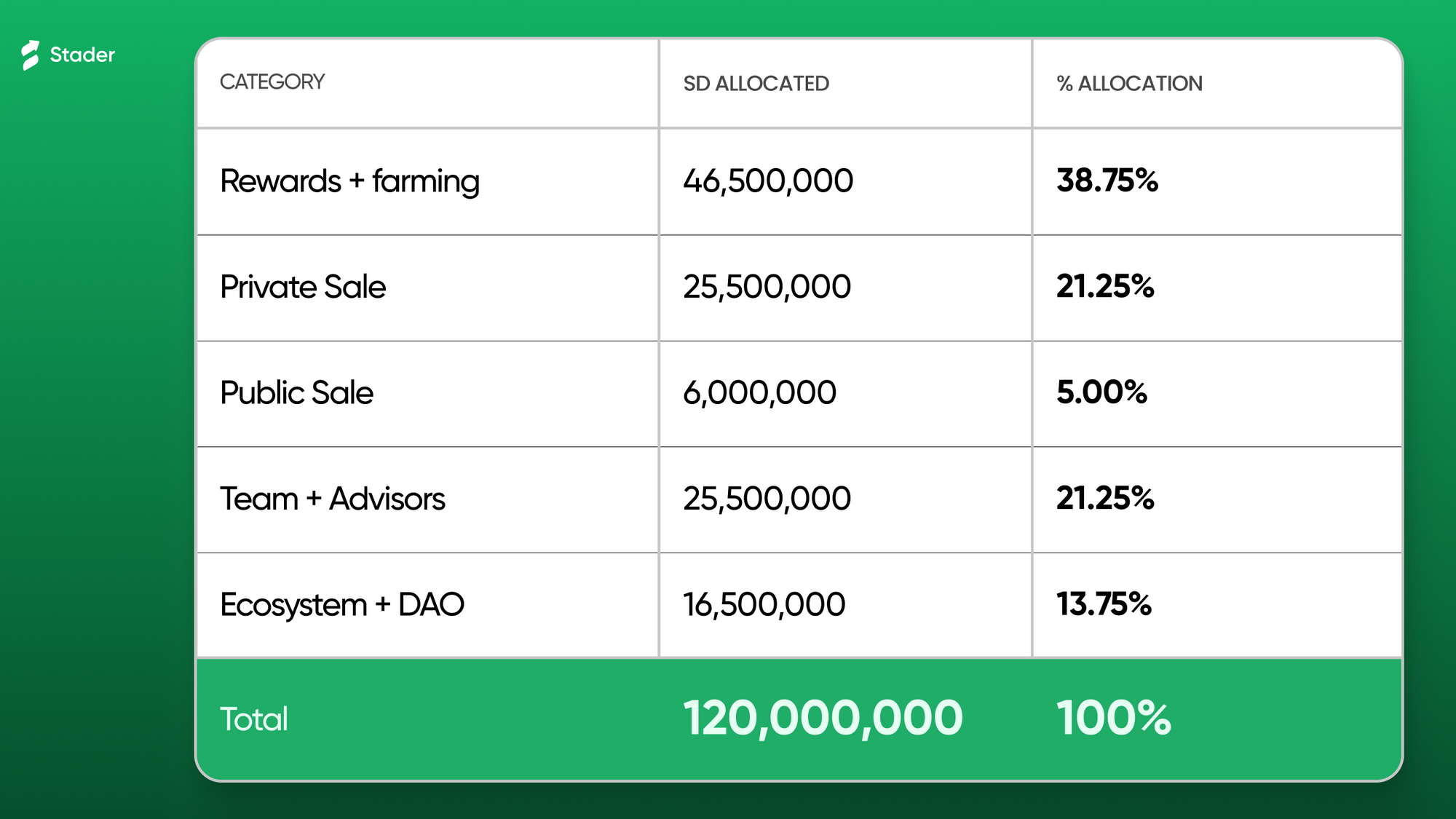

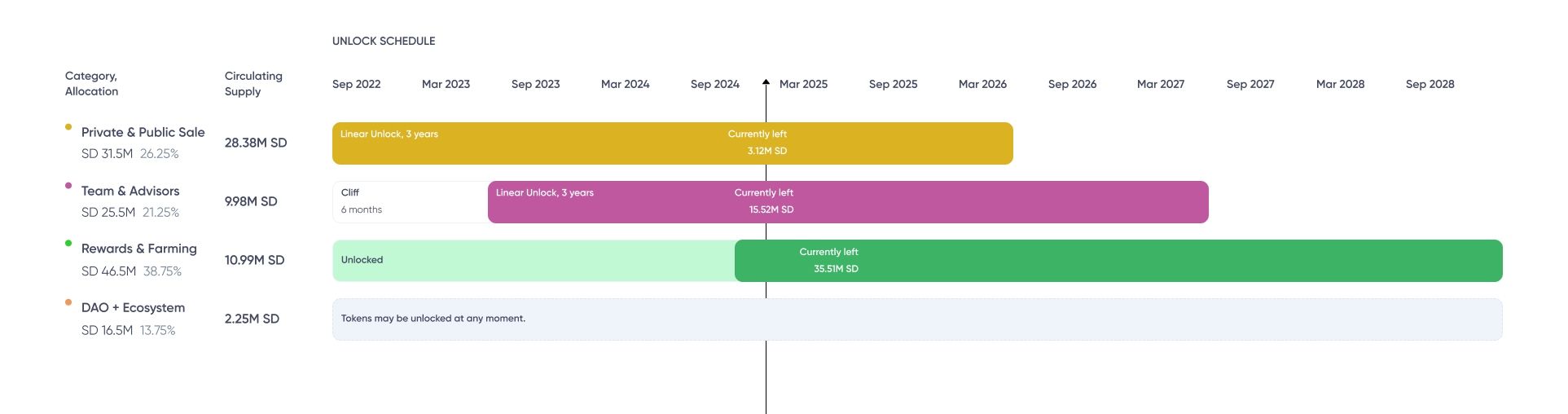

The SD token is capped at a total supply of 120Mn tokens. The distribution ensures sustainability and equitable access:

- Rewards & Farming: 38.75% (46.5Mn SD tokens) of the supply is allocated for incentivizing liquidity and ecosystem participation. The release schedule is determined via governance proposals.

- Team & Advisors: 21.25% (25.5Mn SD tokens) of the supply is dedicated to the team and the advisors to Stader. This comes with a 6-month cliff followed by linear vesting over 36 months.

- Private Sale: 21.25% (25.5Mn SD tokens) of the supply is dedicated to the private sale by Stader during TGE. 0–5% unlocked at TGE, with linear vesting across 36 months post-TGE.

- Public Sale: 5% (6Mn SD tokens) of the supply was allocated to the Public sale. See more details here.

- Ecosystem + DAO Fund: 13.75% (16.5Mn SD tokens) is allocated for governance-determined initiatives.

This structure ensures long-term alignment between the protocol’s goals and its community.

Listings & DeFi opportunities

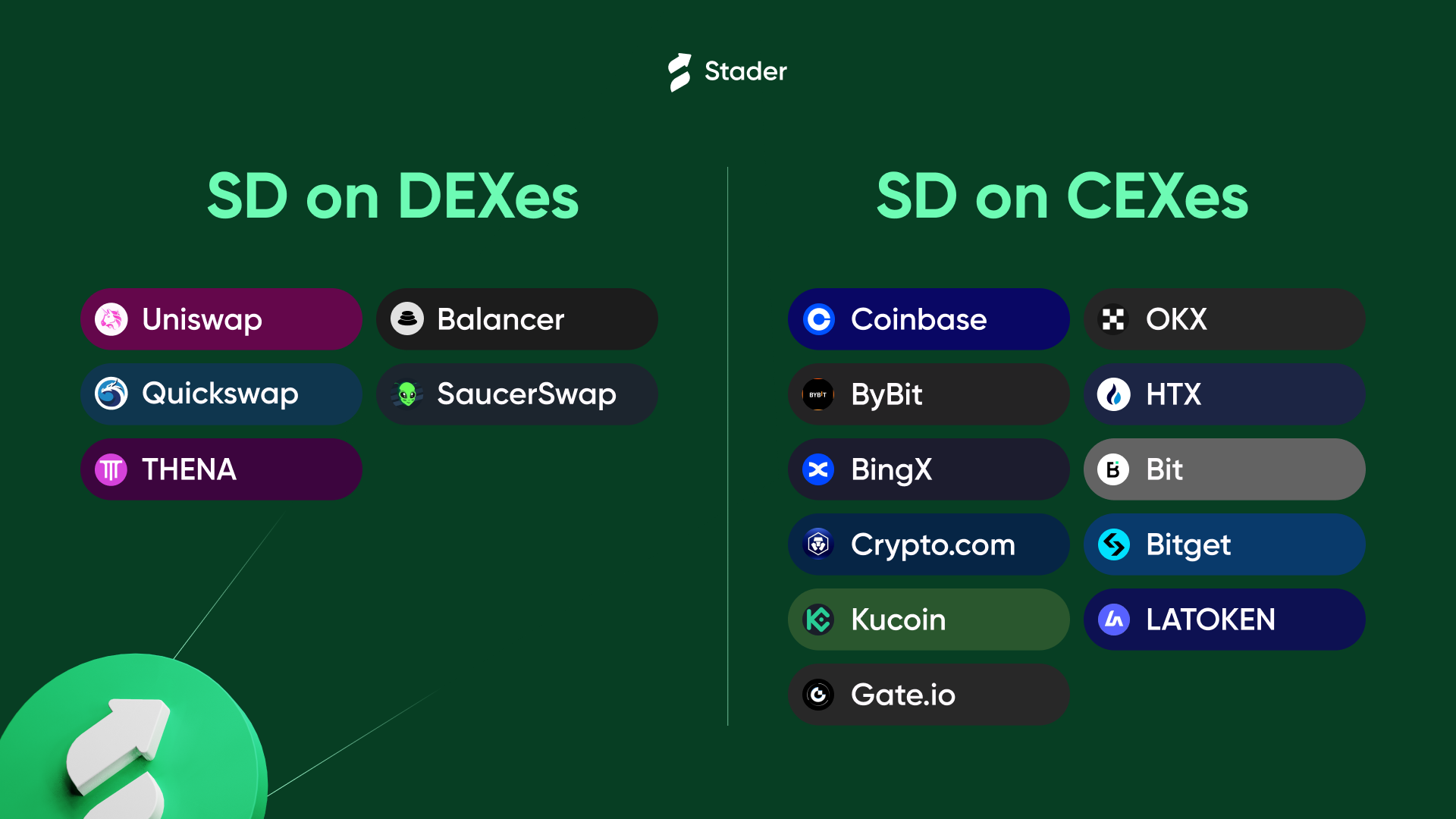

SD tokens are available across major centralized and decentralized exchanges, ensuring broad accessibility:

- Centralized Exchanges (CEXs): Coinbase, OKX, KuCoin, Gate.io, Crypto.com, Bybit, HTX, BingX, LATOKEN, BIT.

- Decentralized Exchanges (DEXs): Uniswap V3 (Ethereum), Balancer (Ethereum & Polygon), Quickswap (Polygon), Thena (BNB Chain).

To further boost liquidity, users can provide liquidity and get rewarded with liquidity pools like:

- SD-ETHx on Balancer

- SD — MaticX on Balancer

- SD-BNBx on Thena

- SD-USDC on Quickswap

SD Tokenomics shaping the Stader ecosystem

The revamped tokenomics enable Stader to create a thriving ecosystem where SD holders actively participate and benefit from the protocol’s growth:

- SD Buybacks: Buybacks are directly connecting Stader’s growth to tokenomics. Stader’s revenue is directly plugged in to buyback SD from the open markets.

- Liquidity Rewards: By providing liquidity to pairs like SD-ETHx and SD-BNBx, users earn compelling yields, driving more liquidity into the ecosystem.

- Delegation Rewards: Delegating SD to the Utility Pool offers annualized rewards of up to 14%, reinforcing its role as a productive asset.

- Governance: SD empowers its holders to vote on critical proposals, ensuring the community’s voice drives decision-making.

The bigger picture: Stader Beyond

The SD Tokenomics Reboot is more than a tactical adjustment; it’s a strategic vision for long-term value creation. By addressing immediate challenges — like token supply and ecosystem incentives — while building mechanisms for sustained utility, Stader Labs has solidified SD’s role as a linchpin for DeFi. Moreover, the strategic initiative to expand to memecoin space showcases Stader’s long-term goal to generate more value and utility for SD.

SD being at the heart of Cabbage’s operations will enhance its tokenomics by utilizing a good portion of the revenue for activities like Buybacks, Burns, and Airdrop rewards, making SD deflationary in the long term.

What’s next for SD?

With a robust foundation in place, the future for SD is brighter than ever. The integration of SD into Cabbage’s operations marks a significant milestone, tying Stader’s utility token with its innovative speculative trading platform.

Cabbage leverages AI-curated opportunity feeds and a cutting-edge trading engine to simplify speculative asset trading. As part of the Stader ecosystem, both Cabbage and Stader’s liquid staking tokens (LSTs) accrue value directly to SD.

Cabbage’s Role in $SD

Cabbage is Stader’s foray into helping people discover the right opportunities in the speculative assets space using AI-curated opportunity feeds tied with a world-class trading engine. Since it is united under the Stader umbrella, both LST and Cabbage accrue value to the $SD token.

Stader expects to generate substantial revenue from Cabbage. Subsequently, all these revenues would contribute to the utility described above concerning buybacks, apart from allowing $SD holders to participate in governance, earn additional yield and other benefits.

By aligning tokenomics with a commitment to decentralization, innovation, and community growth, Stader Labs ensures that SD remains not just relevant but essential in the DeFi ecosystem.

Conclusion

The evolution of SD tokenomics highlights the power of a thoughtful, community-driven approach to building in DeFi. From incentivizing participation to fostering decentralization and creating sustainable value, SD stands as a beacon of innovation. As Stader Labs continues to push the boundaries of what’s possible in DeFi and crypto, SD holders are not just participants but key stakeholders in this transformative journey.