ETHx Deposits | Tech Explainer

About Stader

Stader is a multi-chain, non-custodial liquid staking protocol on six chains, including Polygon, Fantom, BNB, NEAR, Hedera and Terra 2.0. With over $120 Mn in TVL across chains, Stader is trusted by 70K+ wallets and a community of 150K+ members.

Stader’s mission is to unlock a passive income opportunity for 1Bn+ people through staking and DeFi. We aim to achieve this by simplifying staking & offering the best yield opportunities with our liquid staking solution across multiple blockchains.

ETHx (following Stader’s convention of an x-for-suffix for liquid tokens) is the liquid staking token for staked Ethereum offered by Stader. ETHx aims to provide stakers, with a decentralized and scalable solution with diverse DeFi integrations.

This blog post aims to give the reader a deeper understanding of how ‘Deposits’ work in ETHx. In our previous post we covered Node Operator Onboarding in ETHx and nuances with respect to the onboarding of permissionless and permissioned node operators.

Deposit Workflow

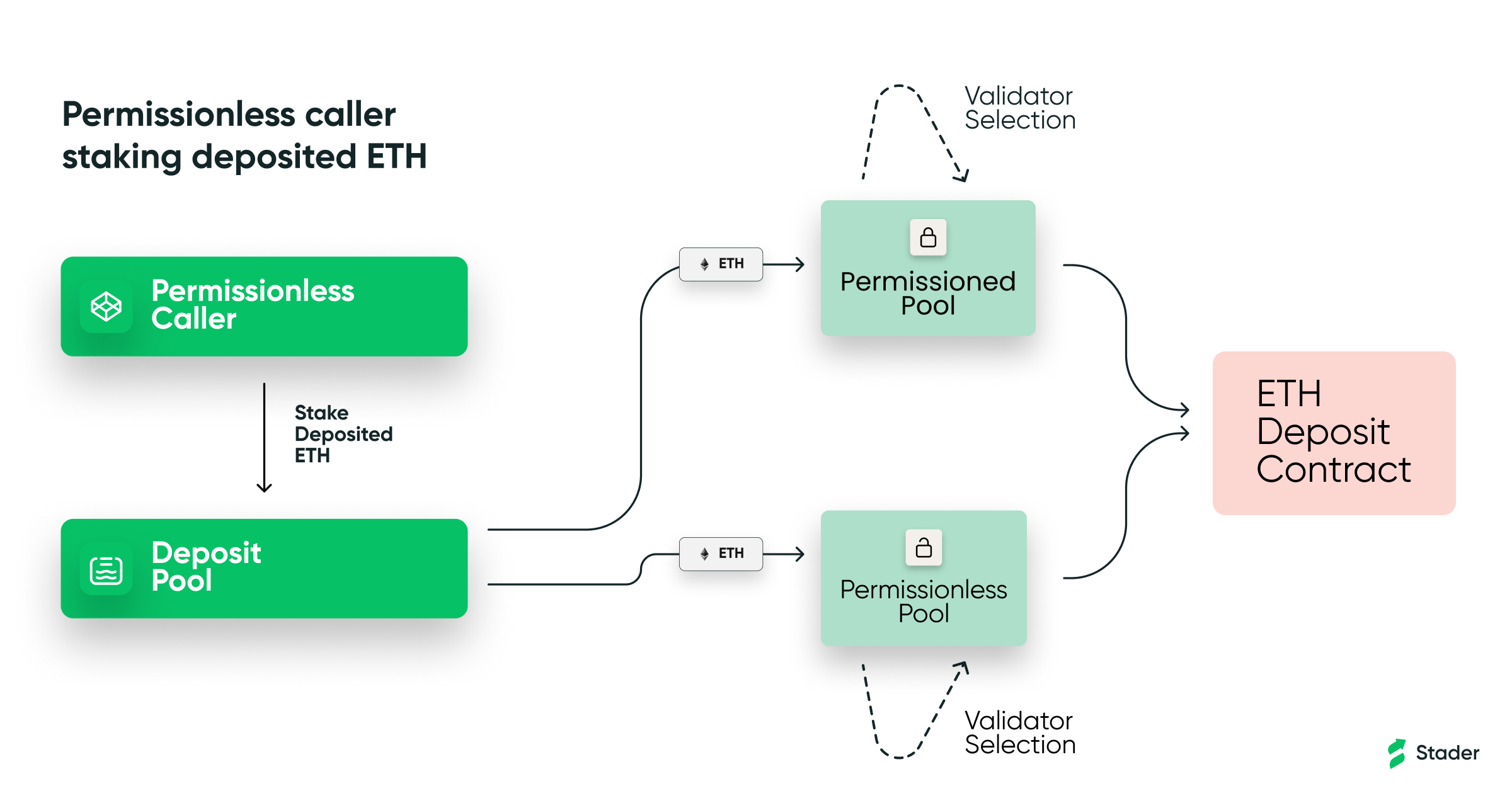

ETHx is built to reduce barriers to running nodes on Ethereum. Empowering individual node operators and enabling home staking is paramount for Stader. With the modular architecture of Stader’s ETHx, several pools with different security bonds, compliance layers and exit requirements can be run while enjoying the shared benefits of security, liquidity, incentive structures, etc. Each pool is assigned an initial pool weight indicating the ideal spread of validators. These weights are subject to DAO governance and are updateable to suit the evolving needs of the protocol. It is possible to balance different pools to their target weights.

Here are a few design considerations taken into account for the deposit workflow.

- Deposit Limits

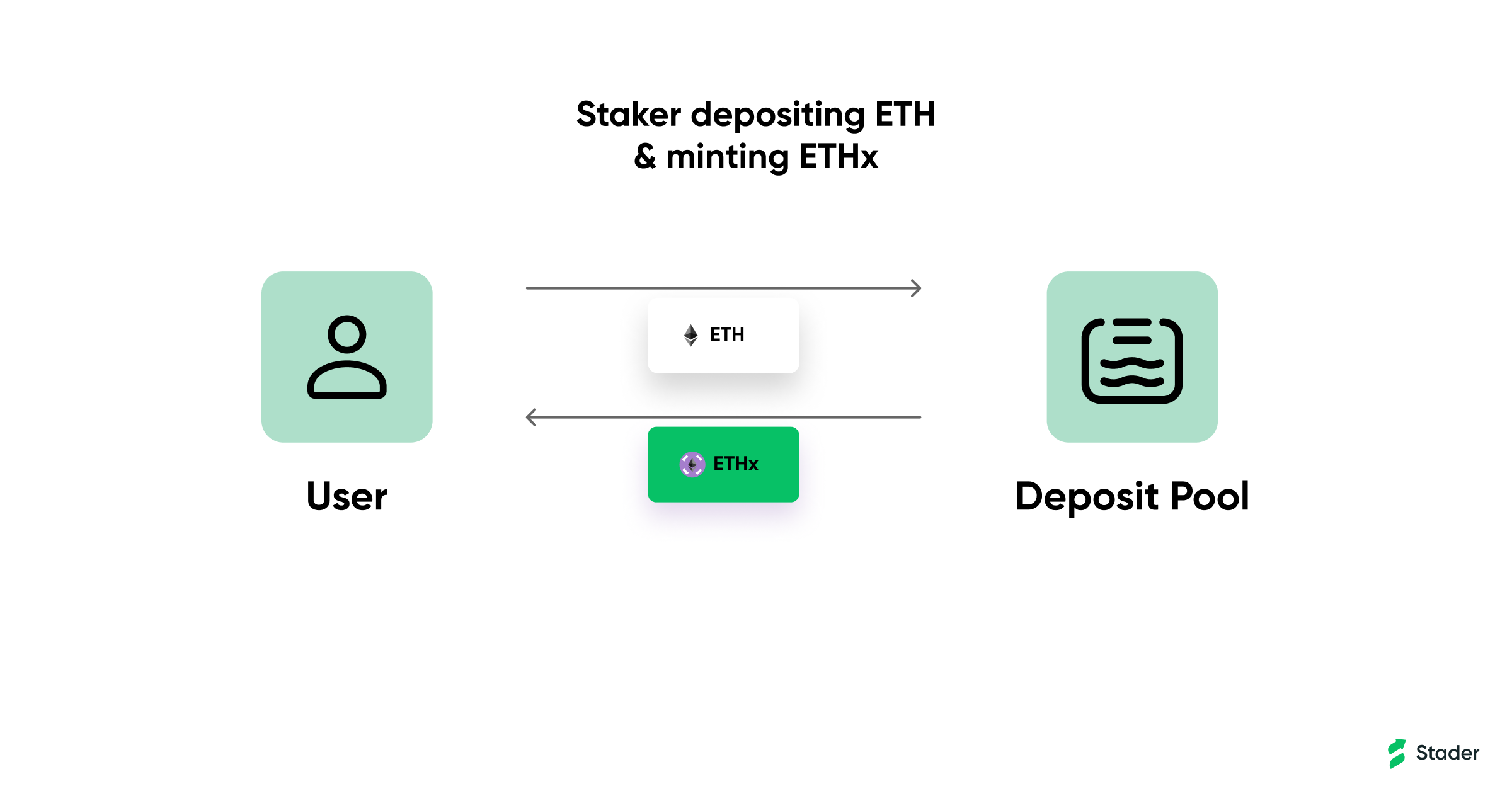

Stader DAO sets the minimum and maximum for staker deposits. A minimum deposit value increases the cost of DDOS attacks, and a maximum ensures safety for asset deposits while avoiding validator shortfall issues. During adverse events, deposit limits are considered zero. All functions in the deposit flow are permissionless, giving complete control back to the community. As part of a deposit transaction, an equivalent value of ETHx is minted and sent back to the deposit caller in the same transaction.

- Stake Allocation to Pools

ETHx smart contracts have target weights for each pool. Several actions, including deposits and withdrawals, are performed, moving the weights of pools from current value to the target value. For example, a weight of 7000bps and 3000bps for permissionless and permissioned pools indicates an ideal scenario where 70% of ETH is staked to the permissionless pool and 30% to the permissioned pool.

Any staker-deposited ETH is retained in the deposit pool until staking to Beacon Chain can happen. There are two methods by which ETH can be staked to the Beacon Chain. The first is to call the batchValidatorDeposit function, specifying the pool for which deposits are to run for. This permissionless and no-cooldown function ensures that the deposited ETH can be staked to a set of validators queued and verified in a specific pool while not exceeding the target weights set for the pool. These guardrails ensure that the target weights governed by the DAO are respected.

The second is via the depositETHOverTargetWeight function callable in a permissionless manner but enforces a cooldown to prevent abuse. This function helps stake all deposited ETH to the capacity available across any pool without disabling deposits. This feature is designed to be fair to all pools over time and enables Stader to stake all deposited ETH as long as the validator supply exists on any pool. Furthermore, this function enables greater stake efficiency and improves returns for all Stakers and commissions for node operators and Stader.

Furthermore, a limit on processed ETH is placed on any single stake allocation transaction preventing timeouts and ensuring that current pool weights do not rapidly deviate from target weights.

- Validator Selection

It is essential to select the proper mechanism to choose a validator(s), from the list of available validators, for each pool while adhering to the broader principles of fairness and decentralization.

For the permissionless pool, we choose a first-come-first-served approach after considering the following factors:

- Due to the sheer diversity of operators, approaches like round-robin are subject to subversion while First-Come-First-Serve is a more elegant solution which leverages time as the decisive factor.

- Permissionless operators, expectedly, spin up fewer than 10 nodes in their lifetime. So concerns about centralization are limited.

- With the SD incentives announced for bootstrapping, it is fair to benefit an early adopter vs. a laggard. This approach matches the validator’s risk appetite with early adoption of the rewards earned.

We choose a round-robin approach for the permissioned set of operators because of the following factors:

- Unlike permissionless NOs, permissioned operators spin up 100s or 1000s of validators at once. Concentrating stake with one operator is not prudent from an operational perspective.

- Round-robin allocation is fairer even to node operators onboarded at later stages.

In essence, every active permissioned node operator is treated equally for the distribution of any eth to be staked.

- Deposit to Beacon Chain

Stader distributes Staker’s ETH to the validators on different pools. For the permissionless pool, 28 ETH is provisioned, and for the permissioned pool, 32 ETH is provisioned. Please note that Stader only distributes staker assets to the validators that clear all security checks. After activating a Validator on the Beacon chain, a node operator can resume the validator duties. In this state, we expect a validator to maintain uptime and not subvert execution layer rewards (MEV, tips). Stader enforces penalties on any abnormal validator behavior. More information on this will be covered in later blog posts.

In this post, we’ve briefly covered how deposits work with ETHx contracts. We walked through Staker deposits, staking the deposited ETH to the beacon chain and associated limits. In subsequent posts, we will cover the other portions of ETHx product– withdrawals, rewards, and oracles.

- For any questions you may have, please reach out to us.

- Join our ETHx alpha list today and be the first to know about $1M in DeFi rewards.