SD Utility Pool: Economics of spinning ETH-only ETHx nodes

Stader recently announced the Phase 2 of ETHx tokenomics with the launch of SD Utility Pool — a first-of-its-kind product in the ETH LST space.

Summary

Stader recently announced the Phase 2 of ETHx tokenomics with the launch of SD Utility Pool — a first-of-its-kind product in the ETH LST space. It empowers permissionless ETH node operators to participate in ETH decentralization with zero exposure to protocol token, all the while making best-in-class rewards. This blog explores in detail the economics of using the Pool and the special incentives planned for our early champions.

Introduction

ETHx is committed to making ETH node operations the most accessible and rewarding in the ecosystem. At launch, ETHx introduced the lowest capital requirement for node operations with just 4 ETH and 0.4 ETH worth of SD (Stader’s protocol token). This enables an impressive 8x leverage and 42% higher rewards (with additional high rewards on bonded SD) as compared to solo staking. ETHx also partnered with Avado and Allnodes to offer lowest cost infrastructure solutions for ETH node ops.

The initiative received strong support and we are proud to have a family of 250+ node operators supporting 1850+ permissionless validators for ETHx today.

But we didn’t want to settle. To further enable more accessibility of ETH node ops, we have come up with a first-of-its-kind solution called the SD Utility Pool.

In our conversations with node operators, one concern that persisted was the treasury guardrails on protocol token exposure. The min 0.4 ETH worth of SD bond required per validator limited node operators from benefiting from the reduced capital requirement. SD Utility Pool solves for this by enabling validators without direct protocol token exposure, eliminating the need for SD ownership.

Operators can choose the extent of SD exposure by choosing from 100% self bond, 100% utilisation from Pool or taking a hybrid approach. We have covered the economics of using SD Utility Pool to scale in detail below.

Utilization economics

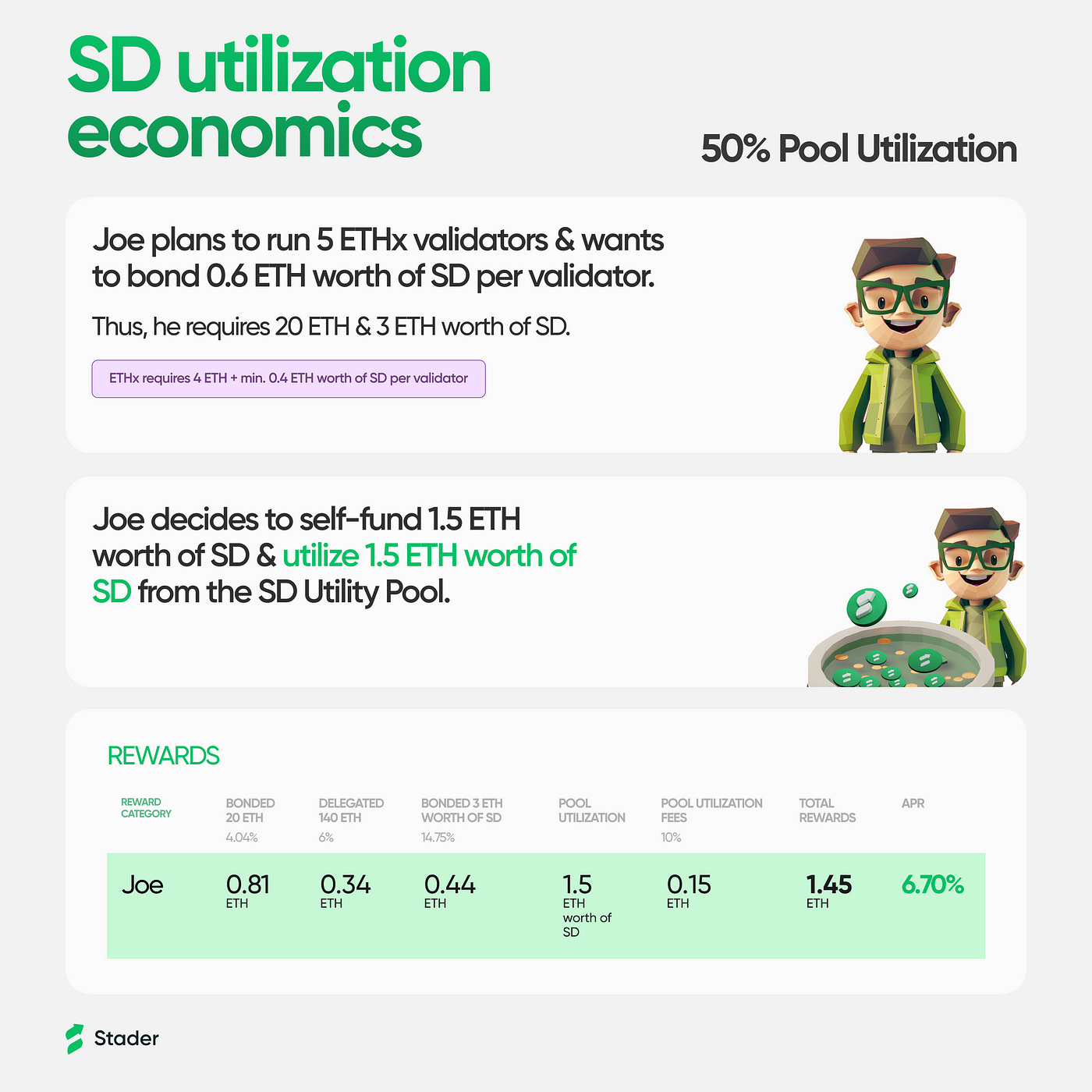

The SD available for node operators to bond from the Pool shall be uncollateralized in nature. They can utilise up to 1 ETH worth of SD per validator. They shall also continue to receive the strong double digit rewards on the SD bond, similar to how they would receive if they had procured the SD by themselves.

However, a utilization fee shall be levied against the SD used. It is currently fixed at 10% but shall be made algorithmically dynamic in future upgrades, depending upon the DAO vote.

Thus the net rewards the node operators receive shall depend upon the portion of SD bond covered by utilizing from the Pool.

Let us understand this better with 2 examples:

Example A: 50% Pool utilization

Example B: 100% Pool utilization

We have created this ETHx Node Operator Reward Simulator for our node operator partners to assess the impact of various ETH & SD investment on their rewards profile.

$50,000 Early Champions Giveaway

Stader has also allocated $50,000 for the early node operators utilizing from the Pool. Depending upon the count of validators, a node operator can receive up to $2000 over and above the rewards received on node operations. The rewards are being distributed on a first come first serve basis. Read more about the giveaway here.

Scale your ETH node ops with ETHx

SD Utility Pool is ready for action with node operators using it to scale with ETHx and benefit from the 85% lesser capital requirement per validator as compared to solo-staking. Current partners are also using it to top up their current SD bond and receive higher rewards.

We have created detailed docs and step-by-step guides to help node operators with the set-up process. Unlock the below benefits as an ETHx node operator scaling with the SD utility pool:

- Lower capital requirements: Just 4ETH per validator needed vs the earlier 4.4 ETH(4ETH + 0.4ETH in SD) required

- Flexibility to choose protocol token exposure: Node operators can now choose to have zero or partial governance token exposure.

- Growth without compromising treasury guidelines: NOs will no longer be constrained by treasury limits on governance token exposure to scale up ETHx validators.

SD Utility Pool: Another step towards a more empowered Ethereum ecosystem

ETHx is committed to maximizing rewards for node operators while minimizing investment and operational hurdles. Phase 2 of ETHx, spearheaded by the SD Utility Pool, is a leap towards more accessible and efficient node operations, aligning with our goal of a stronger, more decentralized Ethereum network.

SD Pool is now live!

Check out the detailed docs here.

Please feel free to reach out to us for any questions or concerns on Discord.

Psst: Don’t forget the $50,000 giveaway for our early champions. Drop your email here to get all the details..