Stader’s Spectacular Growth Story

New Launches and TVL

New Launches and TVL

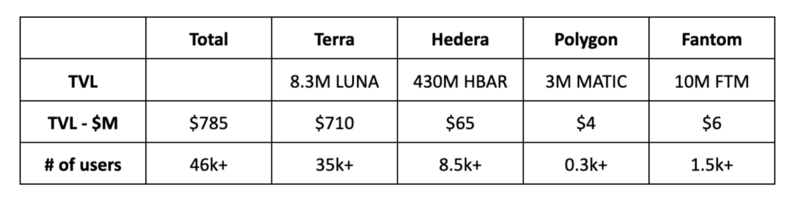

Stader is on an expansion rocketship to bring the best of staking and DeFi to its users. On Terra, our TVL is ~ 8.3 Mn Luna and we are excited to bring our fourth product, Degen Vaults, to our community after the overwhelming success of its beta launch. Building on its success on the Terra Blockchain, Stader is also rapidly expanding into other PoS blockchains. We are now live on Hedera, Fantom and Polygon. All that in a span of just few months!

Our combined TVL across all blockchains is currently at $800 M with our total no. of users having reached 46000+ and this is just the beginning! We further continue to strengthen our focus on partnerships and integrations to bring greater value to our users.

Revenue Update

Our current Annual Revenue Run Rate is at ~ $6.3 Mn* and we have witnessed a 2X revenue run rate within the last 2 months.

Stader’s multi-chain approach and wide product basket enables diversification of revenue sources, thereby minimizing risk and augmenting growth opportunities.

*Consideration of 14-day average price for L1 assets

SD Staking

Stader (SD) token is the native governance token of the Stader protocol. SD staking is currently live only on Terra and rewards are non-inflationary and paid out only from protocol revenues. As of today, ~15% of the protocol revenue is shared with SD token stakers.

The SD token is a native ERC-20 token. For staking, anyone can bridge the SD token to Terra via Wormhole. The SD token on Terra is called whSD. Users can currently earn an APR of ~13% on whSD staking. The unstaking period for whSD is 21 days.

You can stake your whSD here.

SD Tokenomics 2.0

Staking whSD tokens gives users xSD tokens. xSD is an auto-compounding token that increases in value over time by accruing SD rewards.

In Tokenomics 2.0, we will enable SD token holders to earn additional booster rewards by locking up their xSD. The longer you lock-in xSD, more will be the reward boost with 3–4X boost for longer lock-ins. The contracts for Tokenomics 2.0 are currently under audit and will be launched soon.

Going forward, the majority of protocol revenue will be used to buyback SD tokens and distribute to SD and xSD stakers.

Expected Protocol Revenue

The protocol revenue is expected to increase manifold going forward. Some of the key business levers that can help drive this growth are:

- Strengthening Liquid token utility across chains (LunaX on Terra, MaticX on Polygon, sFTMx on Fantom)

- Expansion to other blockchains such as Near, BSC and Solana

- Expansion to Institutional solutions in collaboration with custodians, exchanges and enterprises