ETHx & SD: Stader’s node operator-centric tokenomics

Home

Blogs

Ethereum

ETHx & SD: Stad...

ETHx & SD: Stader’s node operator-centric tokenomics

Executive summary

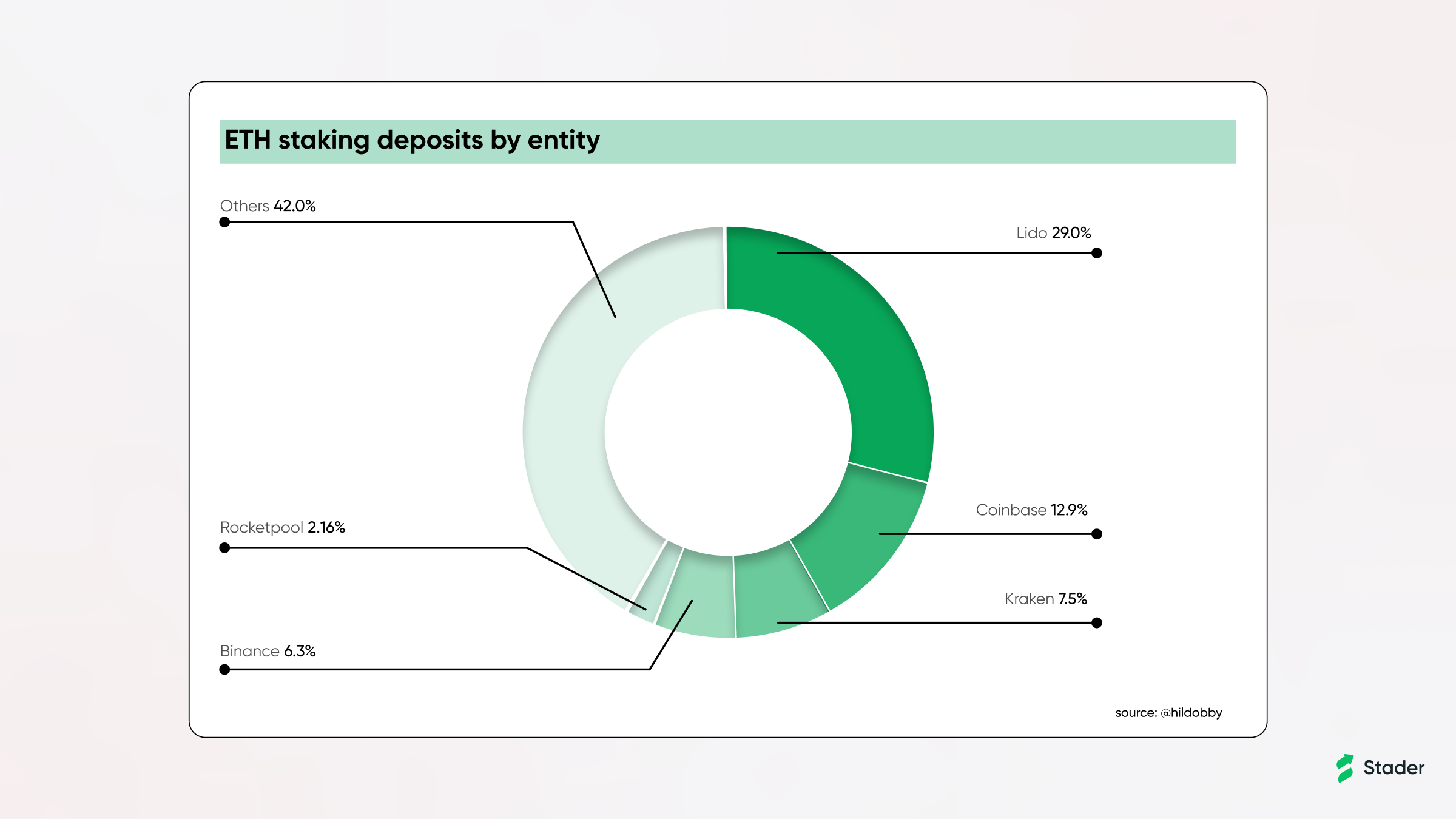

Ethereum staking is centralized with ~50% of all staked ETH flowing through the top 3 entities. There is an urgent need for more decentralized alternatives for users — this will only be possible with a wider section of the ETH community choosing to run nodes permissionlessly.

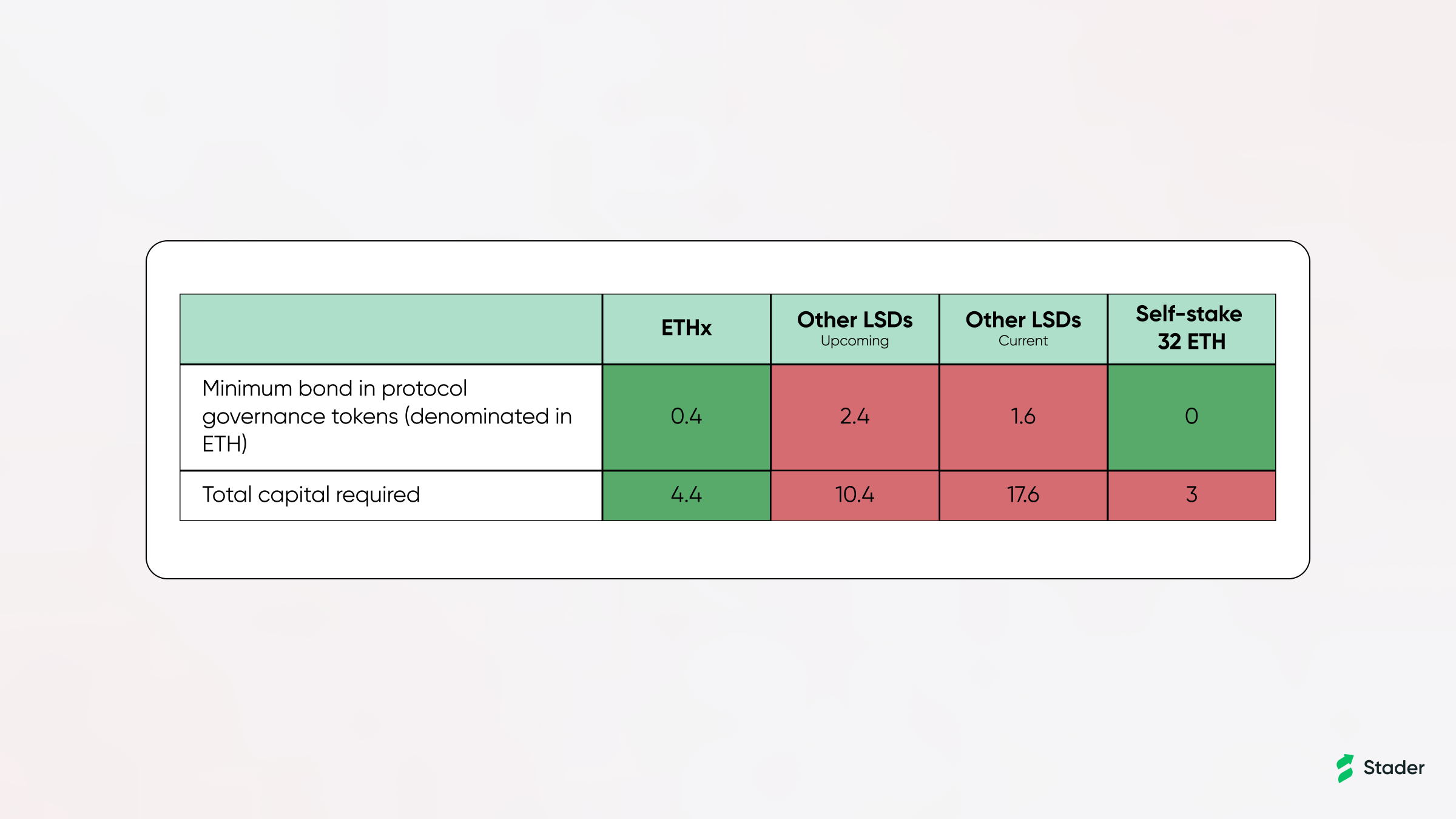

Today, permissionless node operators face multiple challenges in running nodes, including high capital barriers (32 ETH for solo-staking, 17.6 ETH with the top decentralized LSD), limited choices if they prefer to run nodes for LSDs, plus the need to have material exposure to LSD governance tokens (1.6 ETH with top decentralized LSD) that could lead to additional volatility.

Given this context, Stader’s ETHx tokenomics have been designed with the following guiding principles:

- Reduce capital barriers to entry for permissionless node operators

- Allow Node operators to regulate exposure to Stader’s SD token based on their convictions and risk appetite

- Align interests between Node operators and Stader with skin in the game, ability to shape the protocol through governance

At ETHx launch, phase 1 of tokenomics will be live and will work as follows:

- Permissionless node operators will need to bond a minimum of 0.4 ETH worth of $SD per validator, in addition to the 4 ETH bond.

- The additional 0.4 ETH worth of $SD per validator will act as additional protection for user funds against poor performance by node operators.

Phase 2 of tokenomics will go live within a few months of ETHx launch and will unlock additional segments of node operators, even those looking for ETH only exposure, by enabling SD borrowing for the $SD bond requirement:

- There will be a way for node operators to also borrow $SD in a collateral-free manner to cover the 0.4 ETH in $SD bond per validator.

- Will allow a section of ETHx node operators to maintain ETH only exposure.

- The borrowed SD will come from SD holders who will lend to node operators to self-bond and in exchange, get both the SD incentives set aside for node operators as well as 10% of Node operator commissions.

With this design, node operators will have the lowest capital requirement of ~4.4 ETH to run ETHx nodes, and will be highly profitable (35% higher ETH yield compared to solo-staking, 20%+ yield on SD bond). In phase 2, node operators can have ETH only exposure (by borrowing SD) and run nodes for LSDs for the first time in the ETH ecosystem. Plus, the ETH yield will still be 30% more profitable than solo-staking.

ETHx is set to be a significant value addition to the Stader protocol with:

- Share of protocol fees to SD stakers

- Node operators lock up SD to run nodes and shape Stader through governance

- Additional utility for SD holders with opportunity to earn upto 2% real yield in ETH by lending SD for Node operator bonds in phase 2

Background: State of Ethereum staking

Ethereum switched over to proof of stake with the Merge in September. Currently, there is 16.8 Mn ETH, worth about ~$27.5 Bn, deposited on the beacon chain through ~525k+ validators. However, ~50% of all staked Eth flows through just 3 entities and these entities work with a limited, permissioned set of node operators.

For the health of the beacon chain, there is an urgent need for more robust, decentralized alternatives that can get a wider section of the ETH community to run nodes on Ethereum.

Node operator’s perspective: Opportunities & barriers

ETH staking has been meticulously designed to allow anyone to run nodes with hardware/bandwidth typically available at home. On top of this, there are some strong reasons for node operators to consider running nodes on Ethereum, including:

- Flexible hardware options — DIY, dedicated hardware (Avado/Dappnodes), VPS

- Different ways to participate — Solo-staking with 32 ETH, Provide 17.6 ETH bond with decentralized LSDs

- Strong community and access to resources — Helpful, welcoming staking community and copious resources make the process of getting started less intimidating

- Earnings in ETH from staking rewards, commissions on pooled user ETH if participating via decentralized LSD

However, there are some key challenges that still remain:

- High capital requirement — Node operators still need 32 ETH (~50k $) to solo-stake or 16 ETH (~25k$) to run nodes for decentralized LSD

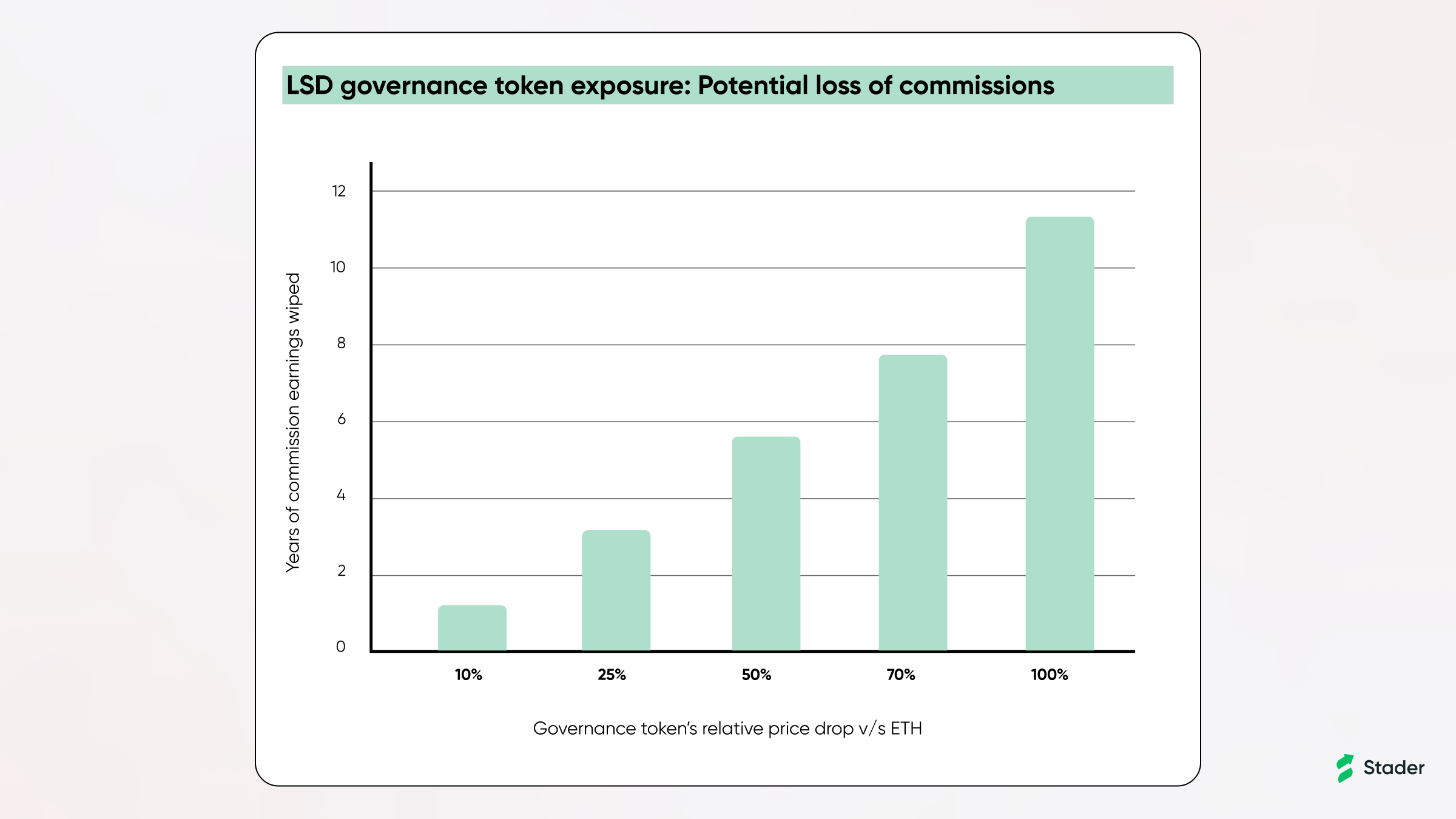

- Material exposure to LSD governance tokens is a prerequisite to participate through decentralized LSD. Minimum 1.6 ETH (~2.5k$) exposure in governance tokens per validator

- Limited opportunities for node operators to participate beyond solo-staking and decentralized LSD

The material exposure to LSD governance tokens with current decentralized LSDs especially can prove challenging to node operators with price drops capable of wiping out years of commission earned:

This has also come through in the form of strong comments from potential node operators in various public forums:

“I think even ETH is too volatile and high-risk. Force-buying >10% of that in LSD governance token is just not viable for us non-degens (which is, like, 99% of the world’s population) Will reevaluate if/when there’s a different model” — Notable crypto researcher

“And it’s a terrible price to pay. If LSD governance token goes to near zero, then you’d have to stake your mini pool for YEARS to make up that money you spent buying LSD governance token. LSD governance token shouldn’t even be a factor here. The team has determined that they want 10% as assurance that a node operator will act accordingly. I personally would prefer to just put in 17.6 ETH instead of 16 ETH and let ETH act as that assurance.“ — Reddit user

Stader’s ETHx tokenomics was meticulously designed considering the key concerns voiced by the NO community.

Guiding Principles for ETHx tokenomics

Tokenomics has implications for many critical stakeholders of the Stader ecosystem — node operators, ETHx users, Stader protocol and token holders. The challenges faced by node operators translated into key principles leveraged to design ETHx tokenomics:

- Reduce capital barriers to entry for permissionless node operators

- Allow Node operators to regulate exposure to Stader’s SD token based on their convictions and risk appetite

- Align interests between Node operators and Stader with skin in the game, ability to shape the protocol through governance

Deep-dive on Tokenomics

Stader’s tokenomics with respect to ETHx will cover the role that Stader’s governance token, $SD, will play in ETHx. The full tokenomics design will be implemented in two phases.

At ETHx launch, phase 1 of tokenomics will be live and will work as follows:

- Permissionless node operators will need to bond a minimum of 0.4 ETH worth of $SD per validator, in addition to the 4 ETH bond.

- The additional 0.4 ETH worth of $SD per validator will act as additional protection for user funds against poor performance by node operators.

- This requirement is also reminiscent of self-stake requirements on popular Delegated Proof of stake chains and will align incentives for node operators and Stader and will also enable node operators to participate in the protocol governance.

Phase 2 of tokenomics is expected within a few months of launch and will unlock additional segments of node operators, even those looking for ETH only exposure, by enabling SD borrowing for the $SD bond requirement:

- There will be a way for node operators to also borrow $SD in a collateral-free manner to cover the 0.4 ETH in $SD bond per validator.

- Will allow a section of ETHx node operators to maintain ETH only exposure.

- The borrowed SD will come from SD holders who will lend to node operators to self-bond and in exchange, get both the SD incentives set aside for node operators as well as 10% of Node operator commissions.

Phase 1 — Minimum 0.4 ETH SD bond for permissionless node operators

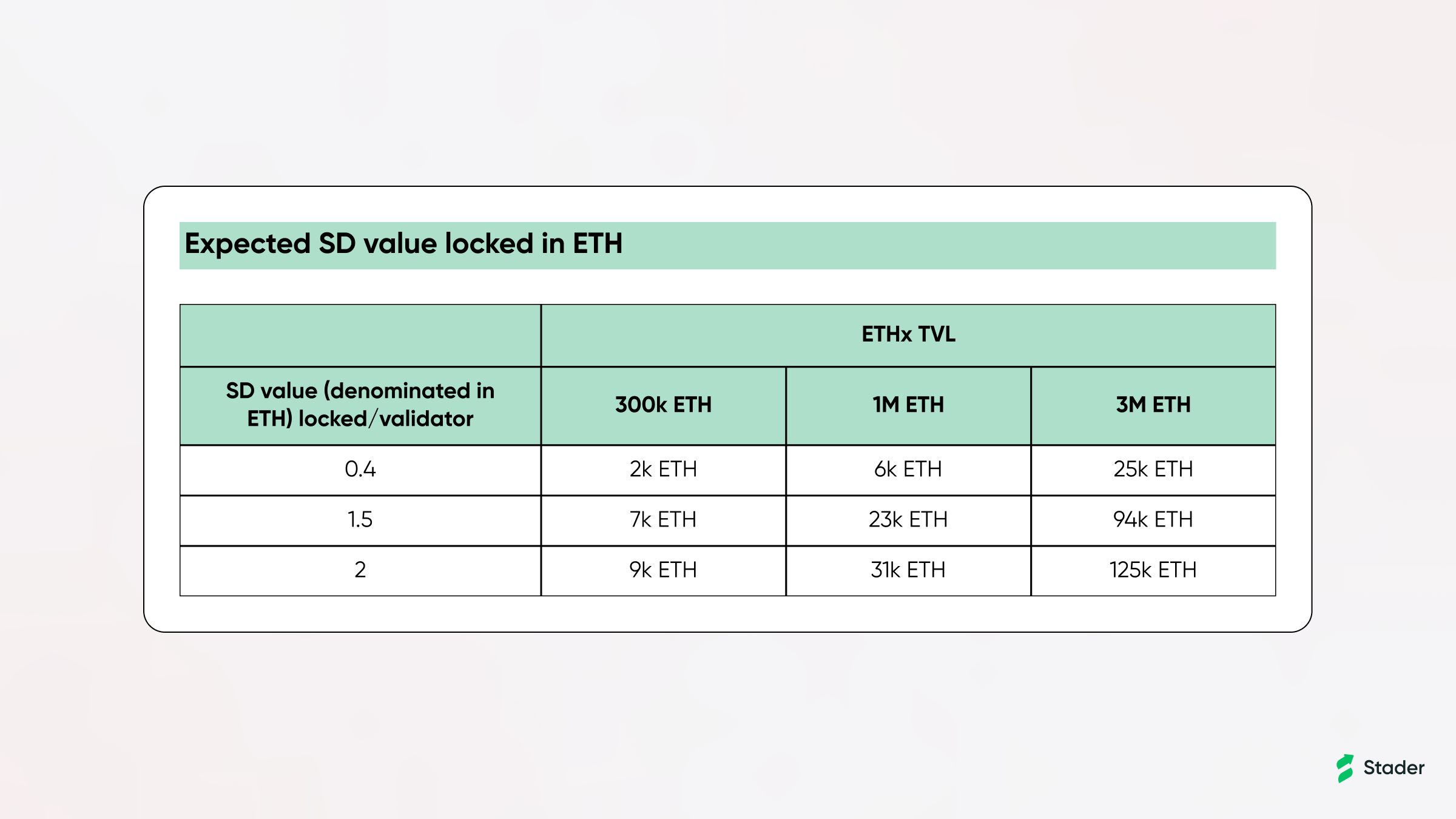

Node operators have to bond at least 0.4 ETH worth of Stader’s governance token, SD, to run a node with Stader in addition to 4 ETH. This will act as additional insurance for user funds in case of any tail risk. Here are the key features of SD bonding design:

Minimum bond requirement

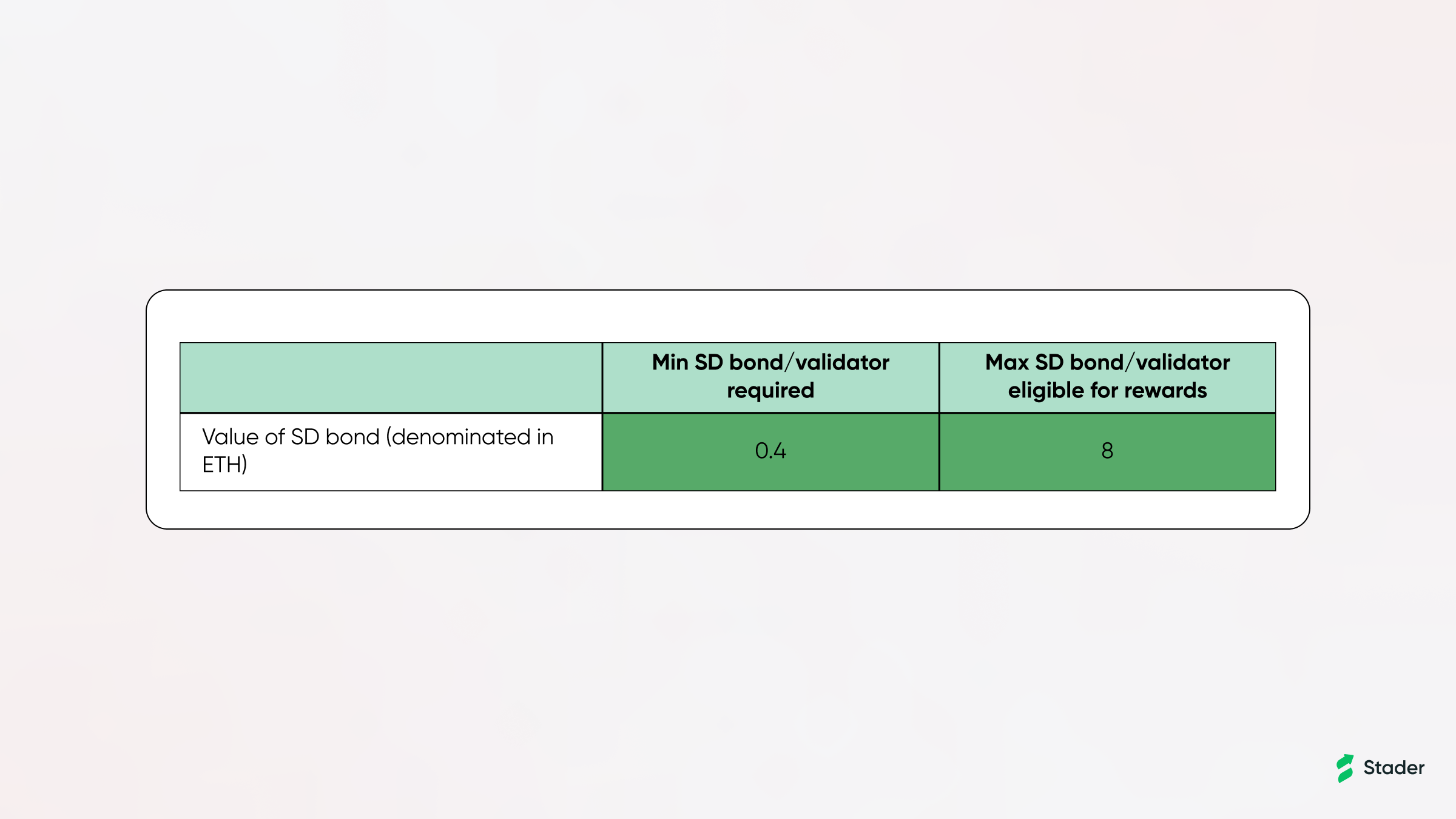

Node operators can start with a minimum of just 0.4 ETH worth of SD to run a node with Stader. This is 75% lower than the requirements of other similar protocols and keeps the total capital required to run a validator with Stader to just 4.4 ETH:

Special incentives

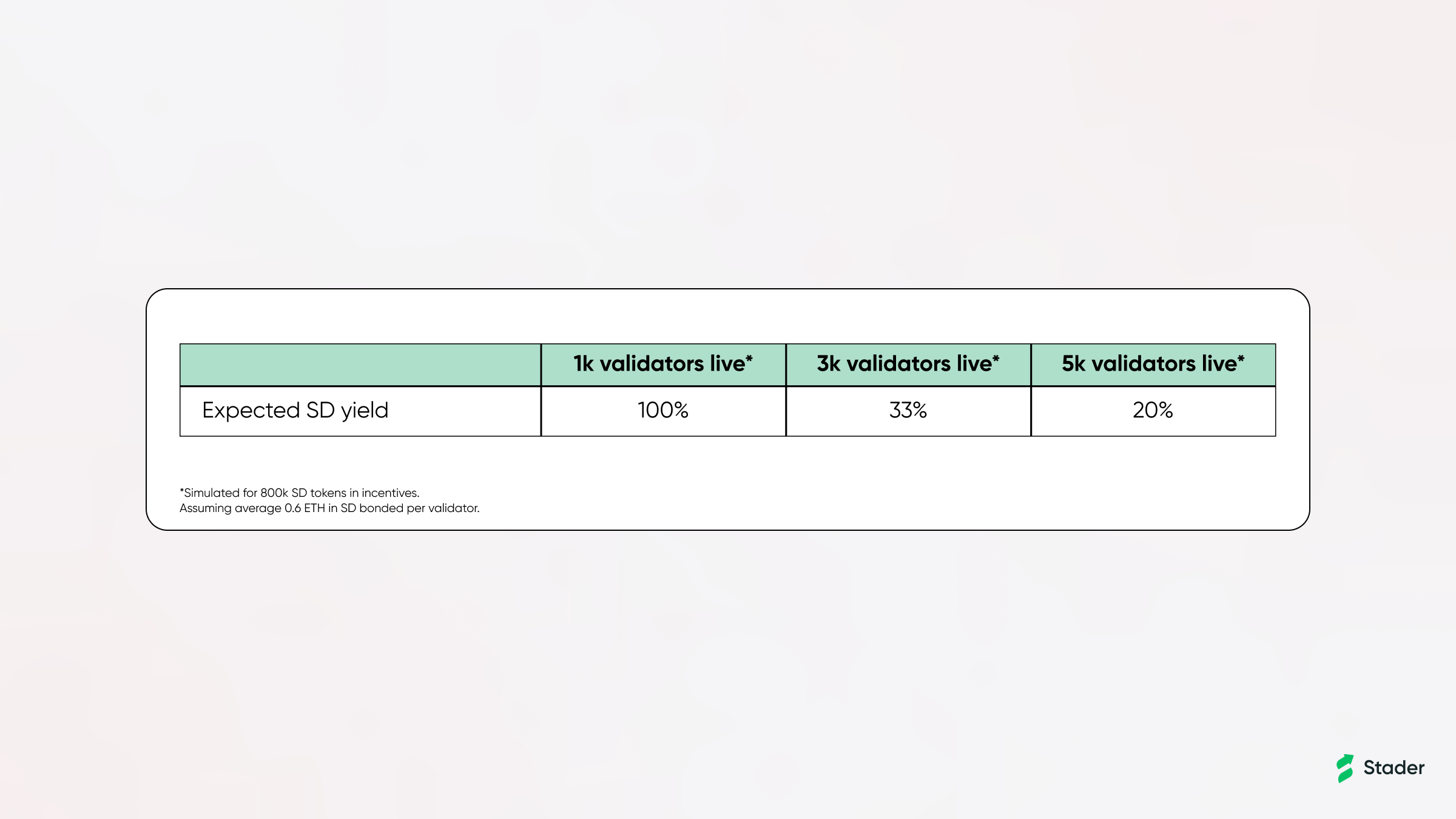

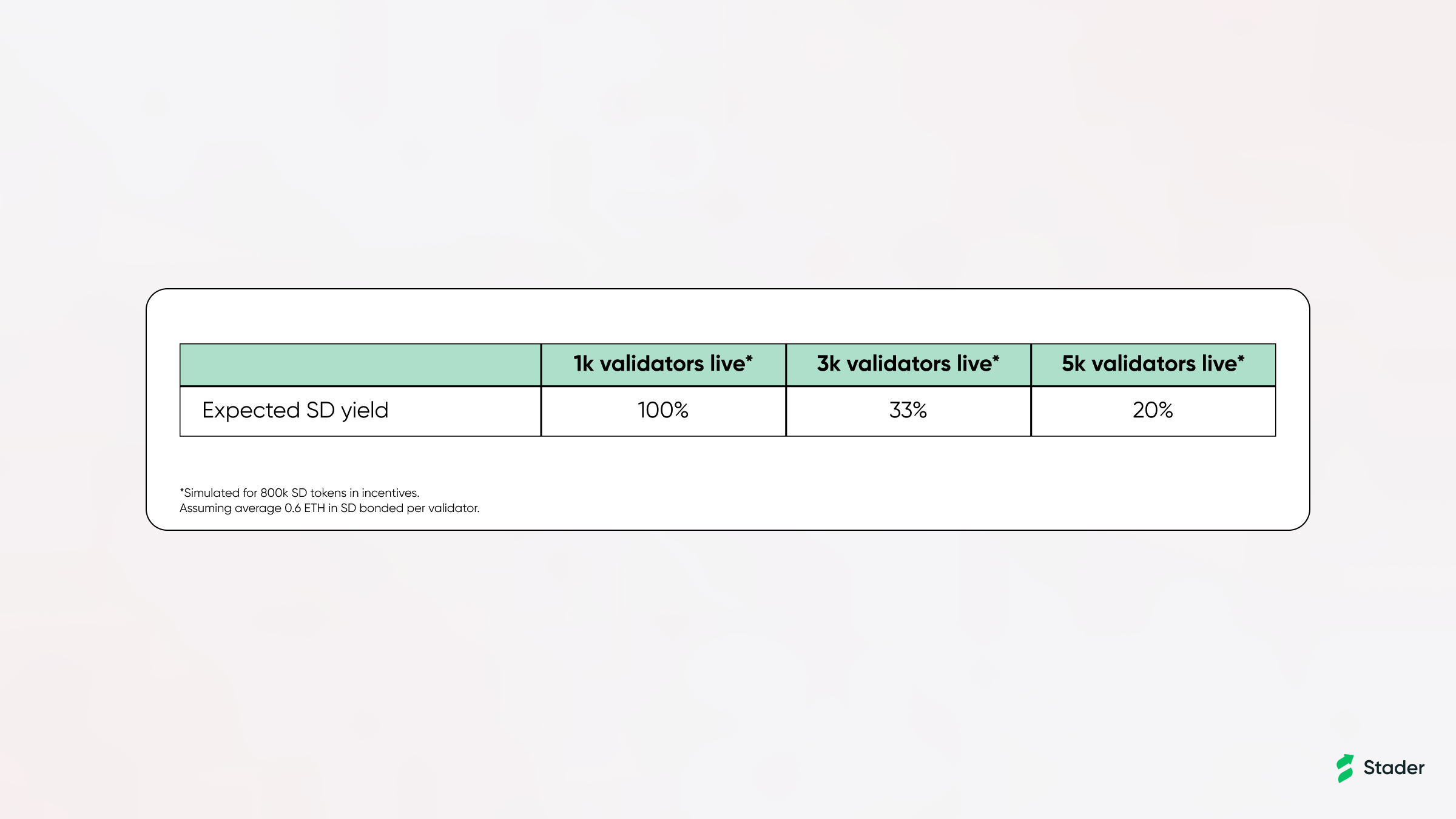

For bonding SD, NOs will receive special incentives that will be provided by Stader. Stader has already set aside ~800k-1.5 mn SD tokens (worth ~1–2 mn $), to be voted on by governance shortly,as incentives for node operators in the very first year of operations.

This will be distributed in proportion of the SD bonded by node operators every month subject to 2 conditions:

- NOs can bond any amount of SD tokens. However, Max SD considered for rewards/validator — 8 ETH

- Minimum SD/validator required to be eligible for rewards during any given month is on an average 0.4 ETH. NOs will still be entitled to earn a base reward in case they fall below this threshold but not the full yield set aside for NOs.

The SD rewards are considered up to 8 ETH/validator to allow node operators strongly aligned to the protocol to participate meaningfully and get the upside from Stader’s success. The max cap also ensures a few large Node operators don’t end up getting most of the SD emissions set up to nurture a diverse, large set of node operators.

Withdrawal of SD

Node operators can withdraw:

- SD rewards: Earned SD rewards every month as they become available to claim.

- SD bond:

- Any SD bond that is beyond 8 ETH/validator threshold can be withdrawn at any point by the node operator

- For SD bond levels below 8 ETH/validator, NOs can get their SD bond back by exiting their validators. Node operators can exit their validators as user withdrawal requests come in on a first come first serve basis if they requested to exit

Phase 2: Collateral-free SD borrowing for Node operators

In phase 2, expected to be a fast follower post ETHx launch, Tokenomics design will also solve for segments of Node operators who have a preference to not hold governance tokens of LSDs. This will be done through a unique lending market that will be set up as follows:

- NOs can spin up nodes with just 4 ETH bond in ETH and their 0.4 ETH worth of SD bond can be borrowed with no collateral

- Risk from user funds needing to be protected beyond 4 ETH, change in token prices of $SD borne by SD lenders and hence, the rewards from Stader incentives and a nominal 10% of commissions earned also flow to SD lenders

- Since all SD will be safely used within the protocol with NOs not having access to these funds and will only be utilized after NO’s 4 ETH bond is leveraged to protect users, no collateral will be needed

- SD Lenders:

- Lending pool:

- SD Holders can lend their SD tokens to a lending pool, that will be used to fund Node operators choosing to use the lending pool with the 0.4 ETH in SD/validator required to spin up validators

2. Rewards for lenders:

- In exchange, lenders will get all SD incentives set aside for Node operators (to incentivize more NOs to participate) as they are taking all the risk from protecting user funds with the SD bond for tail risks that have used up the 4 ETH bond from Node operators

- Lenders will also get access to 10% of Node operator’s commissions on user’s staking rewards, providing them real yield in ETH

3. Withdrawals for lenders:

- Can withdraw SD from the lending pool immediately as long as the pool is not 100% utilized.

- In the rare case where utilization is at 100%, SD lenders can request exits and validators will then be queued for exit and will be provided first come first serve preference in facilitating any user withdrawals

Tokenomics’ impact on Node operator economics

Capital required by Node operators

The minimum capital in SD required by NOs in phase 1 to run nodes will be just 0.4 ETH. Implies total capital of just 4.4 ETH to run nodes.

In phase 2, this can remain at just 4 ETH if NO chooses to borrow the SD bond from the lending pool instead.

Profitability of Node operator

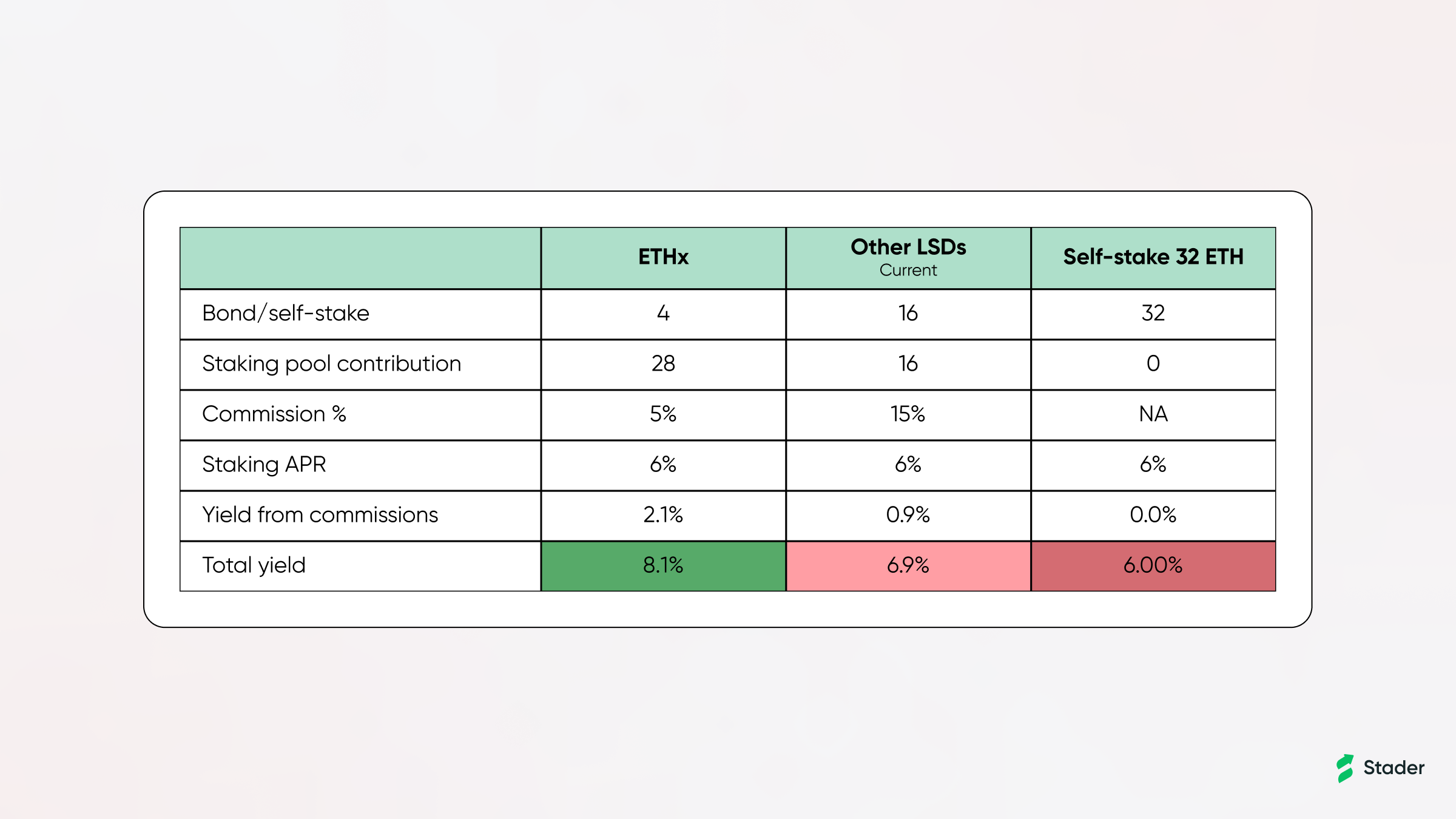

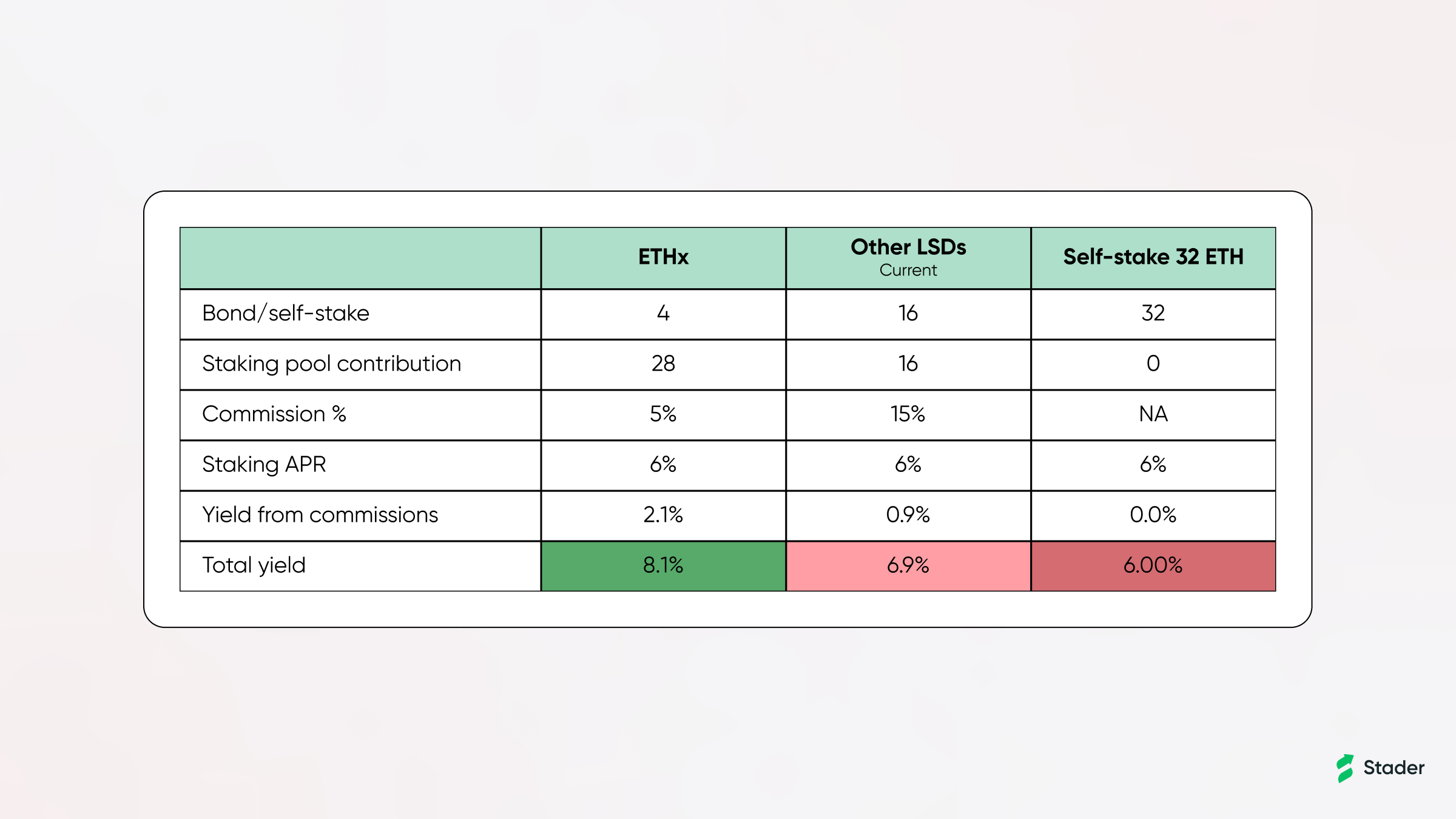

Given the 4 ETH requirement on ETHx provides higher leverage, ETH denominated profits for node operators would be 35% higher than solo-staking at 8.1%

Stader’s special incentives for node operators will further boost this profitability further. The stand-alone yield on SD bond for Node operators is expected to be quite lucrative when ETHx launches.

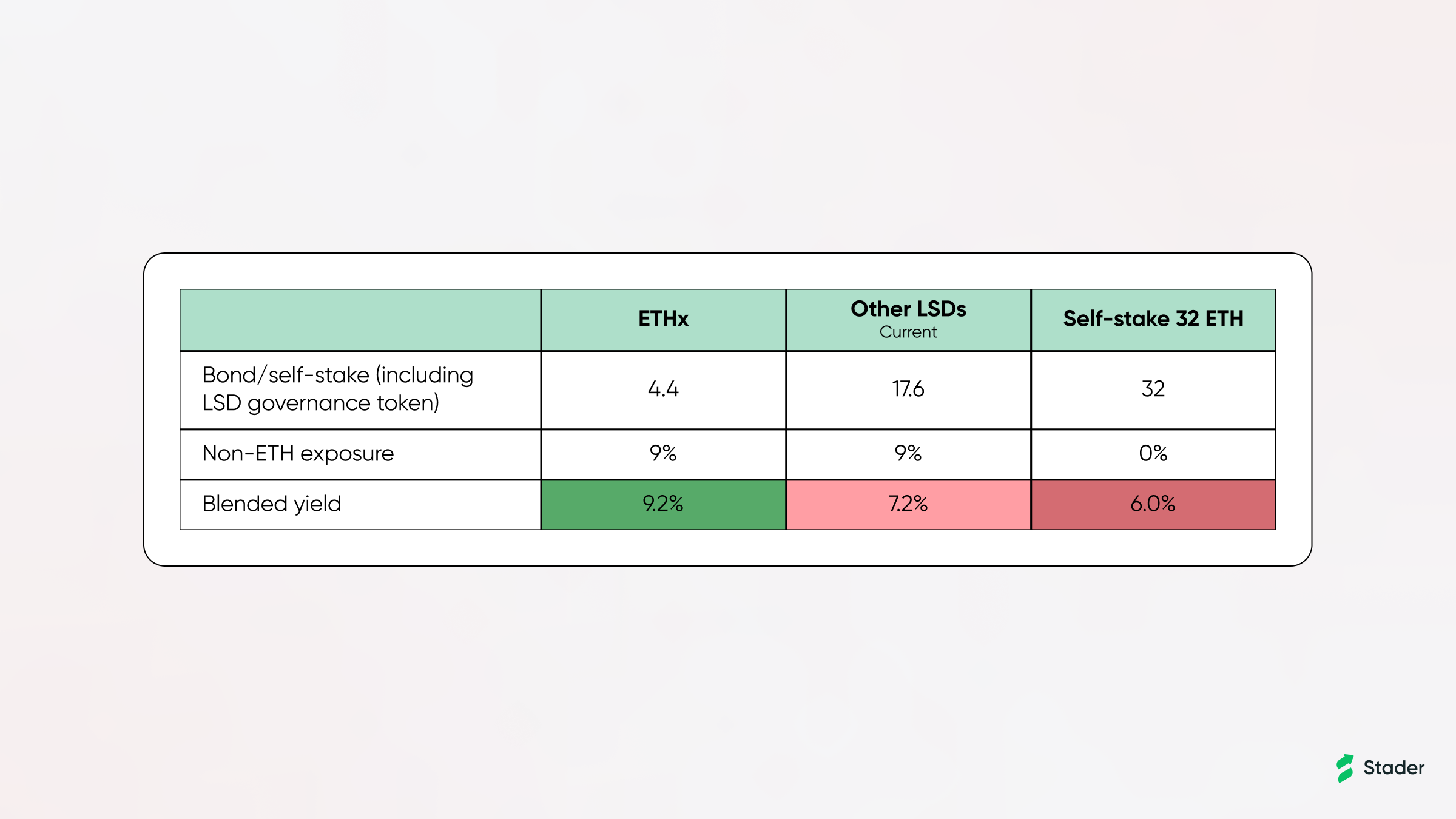

To be conservative, we will take the 5k validators case to provide blended yield across ETH and governance tokens for Stader as well as other decentralized LSDs below:

Stader’s ETHx will enable node operators to get best in class yield considering ETH profits and blended profits both. This is made possible while being able to participate in running nodes for ETHx starting at just 4.4 ETH/validator.

And, with phase 2 bringing SD borrowing, ETHx will be the only opportunity outside solo-staking where node operators can have ETH only exposure. After accounting for 10% of commissions being redirected to SD lenders for providing the 0.4 ETH bond in $SD, expected yield will still be ~7.9% ETH only yield, which is 32% higher than solo-staking rewards.

Value accrual to SD

ETHx adds utility to SD token through 3 important mechanisms:

- Protocol fees to SD stakers:

- Across chains, Stader charges a percentage of user’s staking rewards as fees. A significant share of these fee revenues will be redirected to SD stakers.

- On Ethereum, 5% of users’ staking rewards will be charged as protocol fee and again, a % share will be redirected to SD stakers

- SD bond requirement for running nodes locks supply and brings a vibrant node operator community to participate in SD and governance

- In phase 2, SD lenders can earn up to 2% additional yield in ETH for lending their SD token, on top of accruing incentives in $SD set aside to attract node operators

- SD lenders will accrue a 10% share of Node operator commission (5% of staking rewards) on validators spun up with borrowed SD

- SD lenders will also get SD incentives set aside for Node operators (to incentivize more NOs to participate) as they are taking the risk of protecting user funds with the SD bond.

Conclusion

Stader’s ETHx tokenomics have been designed to ensure node operators can participate in running nodes for ETHx with the lowest bonding requirement (4 ETH + 0.4 ETH in SD) in the ecosystem and will be highly profitable (35% higher ETH yield compared to solo-staking, 20%+ yield on SD bond).

In addition to this, with phase 2 of ETHx tokenomics (expected within a few months), node operators will be able to have ETH-only exposure and borrow SD for the 0.4 ETH in SD bond from SD holders with no collateral. Plus, the ETH yield for such node operators with ETH-only exposure is expected to be 30% more profitable than solo-staking.

We would love to hear thoughts and feedback from the community on our tokenomics. Please jump onto any of our communities across socials and share your feedback.

To stay up to date with what we are building, follow us on our socials: Twitter | Telegram | Discord or sign up here to join the ETHx mailing list and be the first to know all the alpha on the upcoming launch.

By:

Vikas Chauhan

Join Stader’s newsletter

Get the latest updates, new DeFi strategies and exclusive offers right in your email box

Analytics

© Copyright 2023 Stader. All rights reserved.