Supported networks

Choose your favourite network and start earning rewards

SD Utility Pool

Contribute to Ethereum decentralisation by delegating your $SD to the Pool and receive double digit rewards!

Delegate Now

How Stader works

Stake tokens

Stake any amount of tokens and earn staking rewards

Receive liquid tokens

Get liquid staking tokens

Participate in DeFi

Use liquid tokens across 40+ DeFi protocols

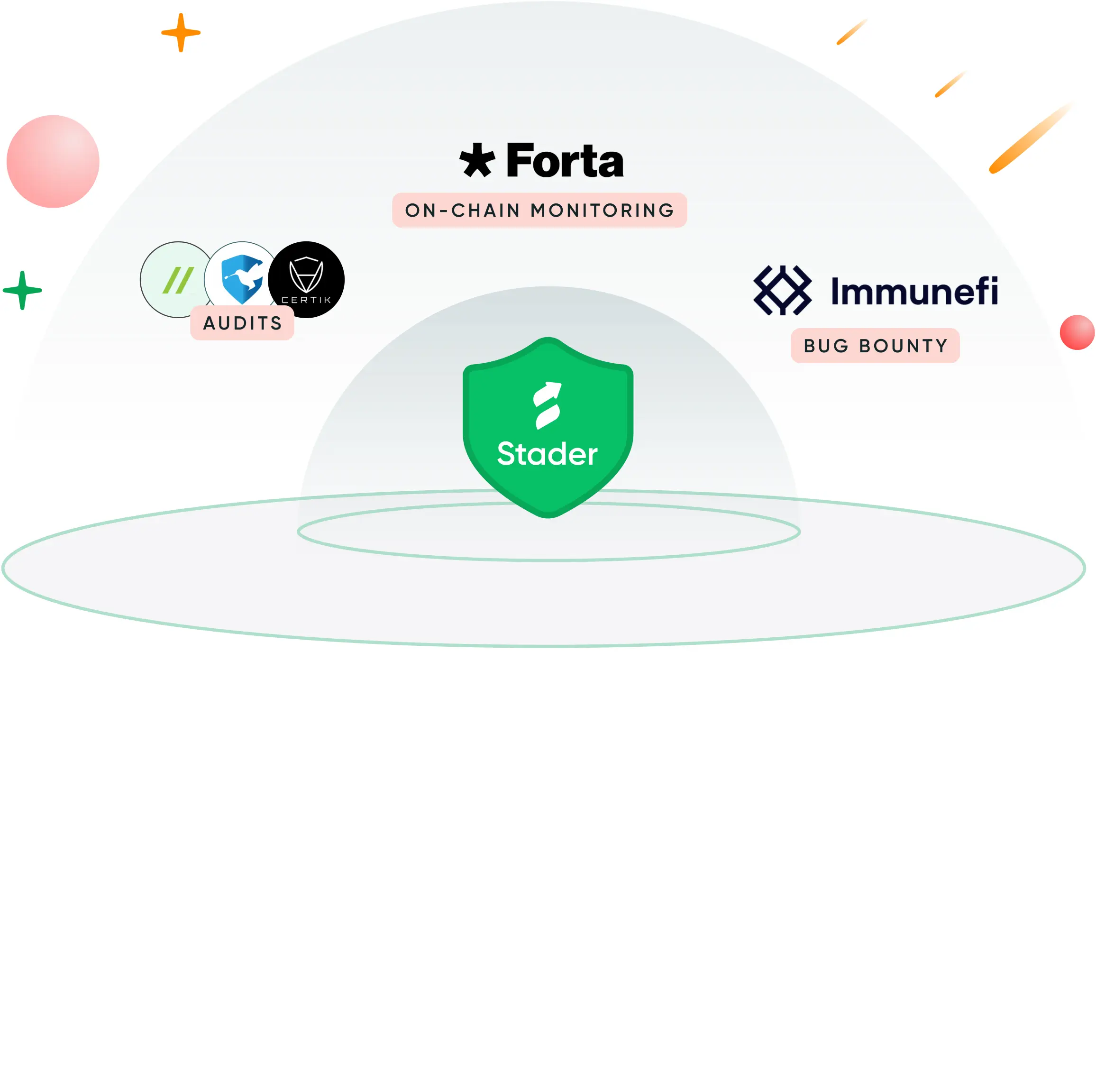

Top security for your crypto

Audited and secured by leading blockchain experts to ensure the safety of your assets

View audits

Our partners

Ledger

Aave

Balancer

Beefy Finance

Swissborg

Quickswap

Anchorage

BitGo

OKX

Gate.io

Huobi

Bybit

Kucoin

Crypto.com

Stay updated with our blog

Join Stader’s newsletter

Get the latest updates, new DeFi strategies and exclusive offers right in your email box

Frequently asked questions

Stader is a non-custodial, smart contract-driven staking platform that facilitates easy discovery and utilization of staking solutions. It acts as an essential staking middleware infrastructure for various Proof-of-Stake (PoS) networks, catering to retail cryptocurrency users, exchanges, and custodians.

Liquid staking is a mechanism within the decentralized finance (DeFi) space that allows users to stake their cryptocurrency to earn rewards while retaining liquidity of the staked assets.

Unlike traditional staking, where the staked funds are locked and inaccessible for a defined period, liquid staking provides a tokenized version of the staked assets. This means users can still buy, sell, trade, or use those assets, making them more flexible and convenient.

Liquid staking offers the dual benefit of better rewards through staking and the ability to continue utilizing the staked funds in other DeFi opportunities.

- Staking rewards: Liquid staking enables you to get auto-compounded rewards from staking your crypto tokens anytime.

- Enhanced liquidity: You can access staking rewards anytime by converting your tokens into liquid tokens, avoiding lock-up periods. You can freely trade or use these liquid tokens in DeFi protocols and unlock additional rewards on top of staking rewards.

Liquid staking is a great option to enjoy flexibility and get staking rewards without locking up your tokens.

Liquid Staking Platform | Earn Liquid Staking Rewards with Stader

Liquid Staking Platforms: Powering the Future of Decentralized Finance [DeFi]

Liquid Staking Platforms such as Staderlabs are powering the future of Decentralized Finance (DeFi) by providing flexibility and accessibility. They allow users to stake assets and earn rewards while maintaining the liquidity of the staked funds, enabling them to participate in other DeFi activities simultaneously.

This increases market liquidity, enhances interoperability across platforms, lowers barriers to entry, and offers opportunities for reward optimization. In short, they make staking more user-friendly and versatile, contributing to the growth and innovation within the DeFi ecosystem.

Benefits of Liquid Staking with Stader Labs

Stader Labs is a liquid staking platform where users can stake their crypto assets without locking them up for a set period. This allows users to use their staked tokens while still earning staking rewards.

Stader Labs offers several benefits over traditional staking methods, including:

- Liquidity: Users can access their staked tokens at any time, which gives them more flexibility which is one of the major benefits of Liquid Staking.

- Security: Stader Labs offers best-in-class security with audits from Sigma Prime, Halborn, Peckshield, and OtterSec.

- Simplicity: Stader Labs has a very simple and user-friendly platform that makes it easier for users to understand and stake.

- Competitive Staking Rewards: With Stader Labs, you can get competitive liquid staking rewards compared to the lower staking rewards on traditional staking.

Stader is a secure, simple, and affordable liquid staking platform, making it a great choice for beginners and experienced users.

Note: *The actual rewards may vary on different factors, including market conditions, staking duration, and stakes amount.

The Future of Staking: Liquid or Traditional?

Even though it is still very early for us to comment on what the future looks like for Staking, some believe that liquid staking will eventually be the majorly preferred form. In contrast, others believe that traditional staking will continue to be the most popular.

Liquid Staking allows users to earn staking rewards without locking up their tokens. In contrast, in Traditional Staking, users have to lock their tokens for a set period of time to earn staking rewards, which can be inconvenient for users who want to use their tokens for other purposes.

Here are some of the factors that will likely influence the future of staking:

- The growth of DeFi: Increased popularity of DeFi will likely lead to an increased demand for liquid staking, as users would want to use their staked tokens to participate in DeFi.

- The development of new liquid staking protocols: With the potential increase in the number of liquid staking protocols being developed, these protocols will likely make liquid staking more accessible and affordable, leading to an increase in the adoption of liquid staking.

Overall, the future of staking looks bright. Liquid staking is gaining popularity, and it will likely continue to grow in the future. It remains to be looked at which staking method would be most preferred in the future.

How Liquid Staking is Revolutionizing the Crypto Industry

Liquid Staking is quickly gaining popularity in the crypto industry as it allows users to stake their tokens without having to lock them up for a set period of time, giving them more flexibility and access to liquidity. Liquid Staking is becoming a lucrative option for stakers who prefer to earn additional rewards while still being able to use their tokens for other DeFi activities.

Liquid staking is still a relatively new technique but can potentially revolutionize how stakers participate in staking. With more liquid staking platforms and further technological advancement, Liquid Staking is likely to become the favorite staking method for many users.

Some of the ways that Liquid Staking can be revolutionary for the Crypto Industry are:

- Increased liquidity: Liquid Staking can help stakers with the opportunity to participate in other DeFi activities by providing them liquidity while still being able to earn staking rewards.

- Increased participation in staking: Liquid staking promotes greater involvement for stakers by offering access to their token's value, even when their tokens are locked up for a specific duration. Liquid Staking could become a favored choice for stakers by delivering simultaneous liquidity and staking rewards.

- Flexibility: Liquid staking bestows users with the benefit of utilizing their tokens' value while still earning staking rewards. Even though the tokens are locked up, the flexibility of liquid staking is preserved as stakers can readily access their tokens' value or exchange the representative tokens on a DEX for the underlying asset if necessary.

Our Expertise in Liquid Staking: Why Choose Stader Labs?

Here are some of the reasons why you should choose Stader Labs for liquid staking:

- Security: Stader Labs is a secure platform backed by several reputable investors. The platform uses a variety of security measures to protect the user’s interests, including:

- Continuous review and on-chain monitoring of all code.

- Audits of smart contracts by reputable audit firms.

- Use of Multi-sig accounts for changing smart contract parameters.

- Ease of use: Stader Labs is user-friendly and easy to use. With our focus on simplifying staking for the users, Stader simplifies Liquid Staking even for a newbie.

- Liquidity: Stader Labs gives users access to liquid tokens for their staked tokens whenever they want. This can be helpful for users who would need to sell their tokens if they want or use them in DeFi.

- Scalability: Stader Labs is a scalable platform that can support many users. This means that users can be confident that their tokens will be staked securely and that they can access their rewards quickly and easily.

Overall, Stader Labs is a secure, simple, affordable, and scalable platform that offers many advantages to its users. If you are looking for a Liquid Staking platform, Stader Labs is a great option to explore and get better Liquid Staking Rewards.

Maximize Your Staking Rewards with the Top Liquid Staking Platform

With Stader, users can earn staking rewards while using the liquid token to participate in the DeFi opportunities on the platform, which provides a major advantage to users who want access to their tokens while still being able to earn staking rewards. This gives the users a major advantage in maximizing their rewards.

Stader Labs has many supported networks, including Ethereum, Polygon, BNB, Hedera, Fantom, Terra 2.0, and Near. Users can stake for any amount of tokens with very low minimum staking requirements.

Here are some of the benefits of using Stader Labs:

- Earn staking rewards while having access to your liquid tokens

- Participate in DeFi opportunities using the liquid tokens

- No minimum staking amount

- Best-in-class security and reliable platform

- Audited and secured by leading blockchain firms to ensure the safety of your assets

The Stader Labs Advantage: Enhancing Your Staking Experience

Stader Labs serves as a liquid staking platform, empowering users to stake their crypto tokens while providing access to their corresponding liquid tokens. Users now have the option to use their staked tokens while continuing to receive staking benefits.

Among the advantages that Stader Labs provides over conventional staking techniques are the following:

- Security: Audits from Sigma Prime, Halborn, Peckshield, Code4rena, and OtterSec demonstrate Stader Labs' best-in-class security.

- Easy to use: Stader Labs' platform is incredibly easy to use and comprehend, which makes it possible for users to stake more easily.

- Auto-compounding: Staking rewards are automatically restaked, which can significantly increase the staking earning rewards for the users over a longer period of time.

One of the main advantages of liquid staking is that users have greater freedom because they always have access to their liquid tokens.

Stader Labs is a great option if you are looking for a convenient, profitable, and secure way to stake your assets.

Analytics

© Copyright 2025 Stader. All rights reserved.